Some advice is timeless.

Albert Einstein once said, “Imagination is more important than knowledge.”

Katherine Hepburn gave us, “If you obey all the rules you miss all the fun.”

Here’s another from your future self, “Start saving for retirement, it’s worth it, I promise.”

If you’re in your 20’s, and you haven’t already started, now’s the time to begin saving for retirement. And no, your employer sponsored 401k or 403b is not enough. Taking ownership of your financial future doesn’t have to be complex or intimidating. In less than 10 minutes I’ll share with you how I am saving for retirement and how you should be too.

Please note, I am not giving out investing advice (I’m not qualified to do that), instead, I’m suggesting you place your money in certain vehicles that have tax advantages, and then use investing strategies that are investment agnostic. What you do with your money when it is in that vehicle is up to you, but putting it in the right account is critically important (and understanding why it is important helps to).

Let’s dive in.

1) Open a Roth IRA

Do you think you are currently earning the highest salary you will in your career? Yes or no? If you answered no, you should open up a Roth IRA. If you answered yes, maybe consider a traditional individual retirement account.

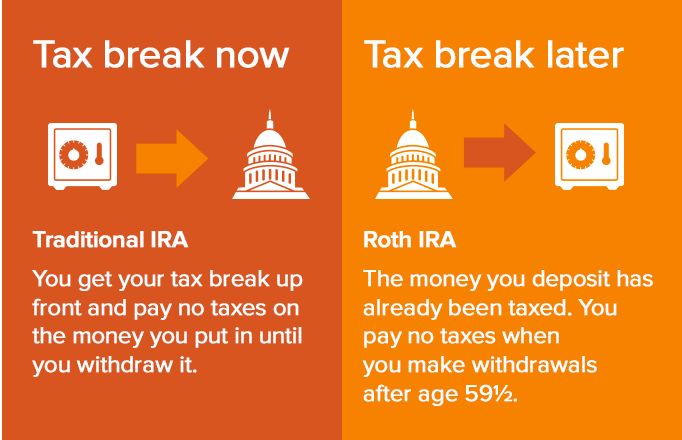

An individual retirement account (IRA) is a type of account you can put money into, just like a checking or savings at your local bank. Why would you put money into this special type of account? Because the federal government wants you to. There are special tax benefits that you only have access to once your money is in this type of account. Think of an IRA as a vehicle. When you put your money in that special vehicle it has certain privileges that other vehicles (your checking account for example) don’t have access to. To keep with the vehicle theme, your IRA has access to the HOV lane, your checking account doesn’t. Make sense?

IRA’s come in two flavors; Traditional and Roth. If you think you haven’t reached peak career earnings (or you make less than $120,000 per year), you should open and place money into a Roth IRA. If you think you’re earning the most you ever will in your career, or your current annual income exceeds $135,000, you should open a Traditional IRA. Here’s why.

With a Roth IRA you place after-tax dollars into the account. Then, when you are 60, and you take that money out of your Roth IRA (to buy a car, a second home, whatever), it’s tax free.

With a Traditional IRA you place pre-tax dollars into the account. Then, when you are 60, and you take that money out, it’s taxed.

The game becomes minimizing your tax burden so that you have the most money when you are 60. Let’s use an example to drive this point home.

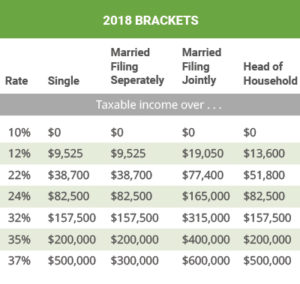

If you’re a single (not married) 23 year old, and make less than ~$80,000 per year, your marginal tax rate is (for 2018 at least) 24%. With this income and age, you’d have a Roth IRA, and you would place after-tax dollars into that account.

Then, when you are 60, let’s imagine you are making more than $80,000 per year, maybe something like $200,000 per year. Your marginal tax rate on $200,000 will be higher, if we use 2018’s rates, it would jump all the way up to 35%. Now that you’re 60, you want to get some extra cash — you take money out of your Roth IRA. This money isn’t taxed when you are 60, because you already paid taxes on that income all the way back when you were 23!

Do you see the benefit? Instead of paying 35% taxes on that money, you already paid 24% tax back when you were younger and earning less. A Roth IRA is perfect for young people that aren’t at their maximum career earnings.

For more specifics on how much you can contribute to a Roth IRA, when you can take money out, and more, please visit a website like RothIRA.com.

2) Invest in STUFF and reinvest your dividends

Most people invest money that is sitting in their IRA — individuals tend not to put money in that account and just let it sit. For savvy savers, investing that money in something (or many things) that will increase in value over time makes financial sense.

One of the most common, and easily accessible places to invest, is in the stock market. If you ever wanted to own a part of Disney, Nike, or Apple, now is your chance — ownership in publicly traded companies is incredibly simple, and potentially a wise decision for how to allocate funds in your Roth IRA.

A lot of fuss, stress, and fear stems from not knowing where to invest your money in the stock market. “Do I buy a mutual fund, a closed-end fund, an exchange-traded fund, or an individual company?” That question makes some people queazy, and I don’t blame them. Stock markets are not easy to comprehend, even on a basic level let alone when you get into derivatives, credit, debt, etc.

However, you’re in luck! There is something even more important that choosing which fund or firm you invest in, and it’s called a DRIP plan.

DRIP stands for dividend reinvestment plan. Dividends are profits that a company pays out to investors. When Nike makes money they give some of that to their investors. Simple, right? With a DRIP plan, you set up your Roth IRA (or whatever investment account you have) to automatically buy more of that stock or fund when you get paid a dividend.

Let’s stick with our Nike example. Let’s say you have a Roth IRA and you just loaded it up with $5,500 (the maximum annual contribution). Through your broker (think Charles Schwab, Merril Edge, etc.) you buy Nike stock. Look at the image below, that’s the most recent (as of November 30th) stock quote for Nike.

You buy 73 shares of Nike stock ($5,500 divided by $75.12). Great, you’ve made your first investment! Now, don’t look at your account for 3 months. Publicly traded companies report their earnings (and give out dividends) quarterly. Time to wait.

Three months go buy. Your Nike stock may be worth more or less than what you originally paid for it ($75.12), but you aren’t too concerned about that. Instead, you’re excited because your dividend reinvestment plan is about to go into action!

Look above in the red rectangle, that’s Nike’s dividend yield. The dividend yield is a measure of how much money you are going to get paid (just for being an owner) relative to the stock’s current share price. In this case with Nike, annually you’ll earn 1.17% of each share’s value ($75.12) for each share you own. $75.12 multiplied by 1.17% equals ~$.88. Dividend yields are expressed in annual terms (four quarters), so we’ll divide this number by 4 to get to our quarterly dividend of ~$.22.

Remember, you own 73 shares of Nike, and for each share you are getting paid 22 cents. 22 cents multiplied by 73 equals ~$16. Sure, you’re not breaking the bank with $16, but what happens next is the best part of a DRIP plan. Instead of taking that $16 and going to the movies, your automatic dividend reinvestment plan buys more Nike shares. You can own fractional shares of stock, and in this case, depending on how the stock price has fluctuated you’ll get a quarter (.25) of another share. Then, after another 3 months you’ll get paid a dividend on that new share in addition to the other 73 you own.

This is the benefit of dividend reinvestment. Each quarter you buy more shares in a company, then next quarter you get paid more (the dividend) because you have a larger stake. Imagine doing this for 30, 40, or 50 years in an IRA account that won’t be taxed when you take out the money! Plus, if you made a savvy investment your original principal (the 73 shares you bought for $5,500) should be worth more than their original asking price.

This is how you save for retirement.

3) Start today, like right now, please

The sooner you put your money in an IRA the better. If you are a young person you need to put money into a tax-advantaged vehicle (aka the Roth IRA we’ve been discussing) NOW. Why? There are three reasons:

- You can only contribute $5,500 annually. Don’t miss out on an opportunity to contribute;

- The sooner you invest the sooner you get paid dividends and can begin reinvesting them;

- Tax laws may change and who knows how long the current structure of a Roth IRA will be available.

With that in mind, start saving today. It’s really pretty simple, and if you can afford to, set aside some cash and get started. Your future self will thank you.

Leave a Reply